The Great Supply Chain Struggle of 2020

THE COVID-19 SUPPLY CHAIN STRUGGLE — 2020 IN REVIEW

by Kevin Reed

Our Sales staff has been answering the same two questions for almost a year now: “What is going on with pricing?” and “What has happened to stock?”. Easily the two most important concerns for both Contractors and Supply Houses.

Nearly every conversation regarding buying material starts with, “How much do I pay, and how soon can I get it?”. The answer to both…more than you used to, and we hope it won’t take too long.

So, how did we get here? It is important to understand the timeline for all that has happened in our industry. We have even gone as far as logging, and explaining, which increases were happening, in which core segments and due to what reasons on our website at https://paramont-eo.com/supply-chain-impact-update/. This information was being shared, in an effort to keep our clients up to date on supply chain issues, as well as rising costs, so they could plan accordingly for their projects.

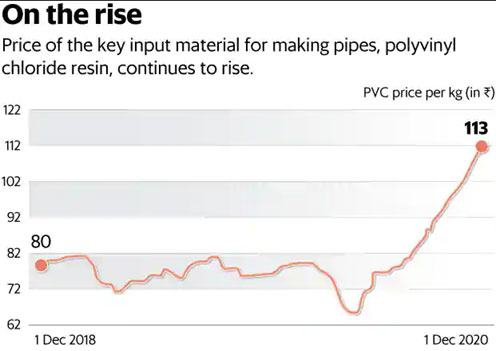

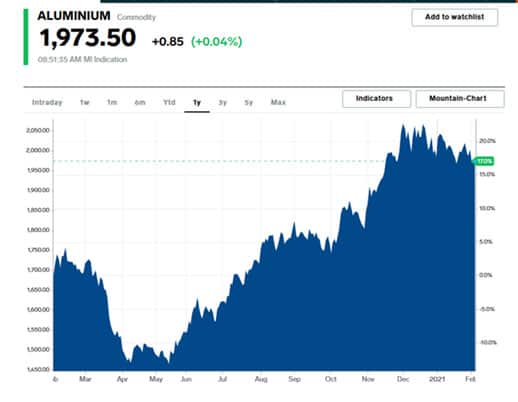

The first tremor in the cost/supply chain came in January of 2020, but actually the surge in the cost of our industry’s base metals started in Spring/Summer of 2019. PVC, Aluminum, Zinc, Copper and Steel all climbed steadily, thanks to a combination of tariffs, market speculation and demand as our economy was humming along.

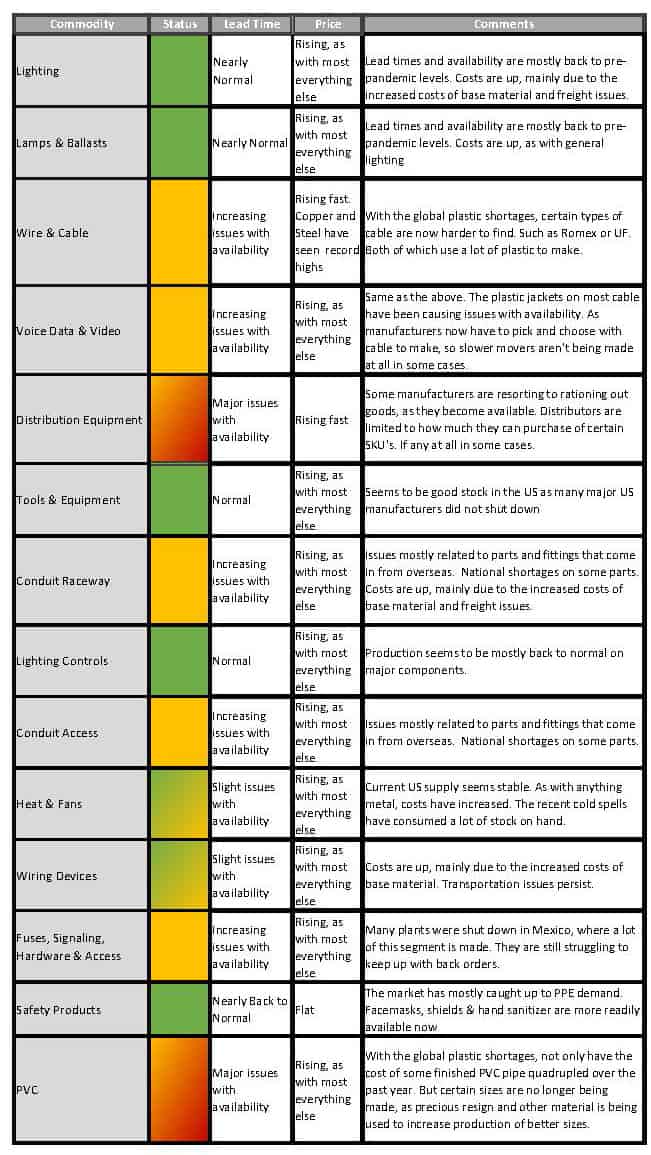

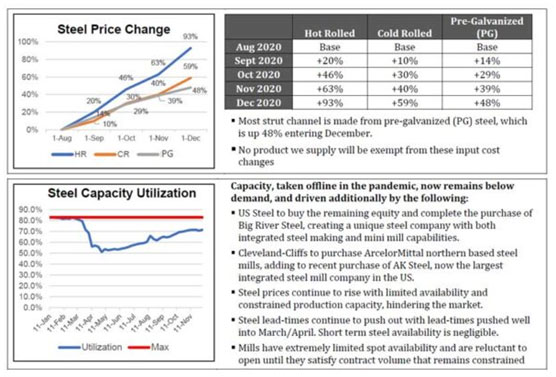

A quick look back at a years’ worth of pvc and metal pricing.

Historically, most manufacturers would often shield these increases until they had to source additional base material or until they saw if the market settled. That would usually mean an actual finished goods price increase wouldn’t happen until the situation had been vetted. The cycle could take 2-4 months before new price sheets would go into effect on many “white” goods.

The extended window would give Distributors time to load new costs, set new contracts and buy new stock at the soon-to-expire price. And most importantly, it would allow time to help us position our customers’ ongoing projects that would most certainly be affected by the higher costs.

And then came 2020. Typically, most major price increases go live to start the year anyway, and 2020 started off no differently. But unlike the usual, expected 3-5% bump, the new increases were often double-digit hikes. That sent a lot of Supply Houses into a buying frenzy, overstocking their shelves before the new pricing took effect. Mind you, this all happened during the winter slow season, which wouldn’t be much of a story, unless something else major happened.

What happened next, hadn’t happened in generations. The global threat of COVID-19 was only starting to be realized in late January. China suddenly locked down tens of millions of people in nearly a dozen cities surrounding the virus epicenter of Wuhan, but their mitigation efforts couldn’t stop the spread outside their borders.

When most of the US went into lockdown at the end of March, it directly led to the supply chain strangle we are still battling. To put things simply, everyone went out and overbought in January and February. Those cold winter months are usually the slowest times of year for manufacturers, so they would often slow production during those months to match demand. So, when the demand skyrocketed early in 2020 many manufacturers didn’t have enough stock to fill orders. In a normal year, they would just ramp up production in March/April to fill their back order log, but COVID-19 made that mostly impossible.

On top of that, transportation options suddenly became limited as everyone started having everything shipped to their homes or distribution points. Just finding a truck was hard enough, let alone the staffing needed to make, or even simply ship material. And it wasn’t just the US that shutdown nonessential business, the rest of the world started to as well and all around the same time.

In a global economy, being able to source parts from many different nations to cut down costs, is a great idea. During a pandemic, relying on so many different places for the components needed to make just a single unit, became a complex liability. You can’t ship a dimmer that is only 90% complete, as you wait for a part to come in from Mexico to actually make it work.

It was a perfect storm. With stocked product already hoarded before the pandemic, slowed or even completely halted production of new product, quarantined container ships, and transportation delays, a new wave of frenzied buying began as Supply Houses attempted to get any remaining goods ahead their competition.

As the year went on, many manufacturers were able to restart, or simply ramp up production due to loosening restrictions and improved COVID safety protocol implementations. And while a lot of product started moving again, it mostly went to fill the backlog.

Similarly, for Electrical Supply Houses like us waiting on that material, product would come in and go right back out again to the list of clients waiting on back orders, with little leftover to replenish stock. Through great partnerships and good planning about 95% of what we needed, we had. That last 5% though, was and still is, brutal to source.

As more and more of COVID-related costs were incurred by the manufacturers, along with their own increased costs from those that supply them, a series of cost increases unlike any I have ever seen in my decades of buying were unleashed. Beyond what the charts above show in terms of the surge in base material pricing, there were now so many other factors at play pushing costs to new highs.

Despite our efforts to help shield our clients from these surging prices, the increases were inevitable; there were simply too many factors at play. We did what we could to price out our stock based on what we paid, and not just what it was worth, to help keep our clients treading water with the projects they had previously quoted, and we also worked to mitigate contracts on behalf of our customers to ensure price guarantees for their projects were held as long as possible.

To be sure, these price increases and supply chain matters affect all of us. The core components of our business here in Chicagoland, Steel Pipe and Copper building wire, both have gone up 60% since last Spring. That not only drives our stocking price up, but also the net cost to our customers and their end users as well.

Other, less transparent impact to Electrical Supply houses, beyond the increased holding costs of stock itself, was the need to honor blanket pricing for a certain period which had been agreed to when the price and availability of stock wasn’t nearly as volatile. In addition, we faced larger freight allowed goals, as many of those went up with the cost of transportation, forcing us to buy more with each PO in order to avoid paying freight. And on top of that came the introduction of new term to our industry, the “Freight Adder”, which basically was a way to charge us more, even when we hit our free freight allowed target.

With all Electrical Supply Houses struggling with the exact same issues, and their clients as well, we realized we really are all in this together.

Whether it be our fourth price increase on steel fittings over the past 6 months, or PVC conduit now costing three times as much as it did just 6 months ago. All we can do now is roll with what comes our way, and make sure our clients are aware of what is happening.

We are so grateful for the support and understanding our amazing customers have shown throughout these unprecedented times. We are continuing to do everything we can to support your projects, your own stock needs and most importantly, to support you. Our clients are, and will always be, the lifeblood of Paramont EO & Crest Lighting.