The So-Called Copper *Crash*

By Kevin Reed

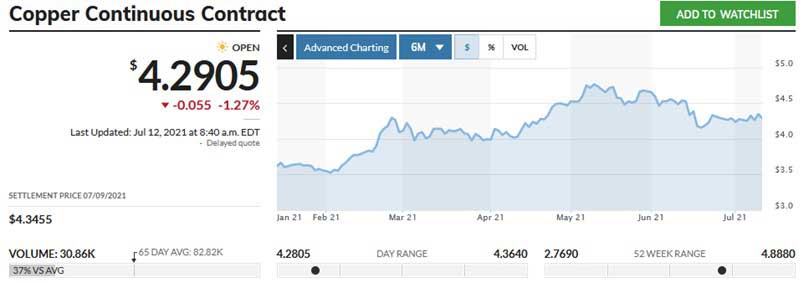

I have heard the term “Copper Crash” being thrown around, as in “What am I paying now, with the copper crash”. Copper, while a tad bit cheaper now, never crashed. Futures in May 2021 were the highest anyone has ever seen. At that time, CU climbed to its highest value per pound of $4.88. That peak, started a small sell off, which was also fueled by speculation over the Chinese economic growth.

While the red metal did dip considerably in the middle of June, it was only 35 cents off its May average. And even with that, the dip only lasted 3 days before an immediate rebound. Since then, for the past 30 days, CU has stayed steady around $4.30 per # for an average. And that still holds true today. Mind you, as recently as last October, CU was still trading at $2.85. Copper did correct some, but it has certainly not crashed.

I see it staying in and around $4.25-$4.45 for the foreseeable future (barring something huge in the global market), as there is plenty of copper to go around right now.

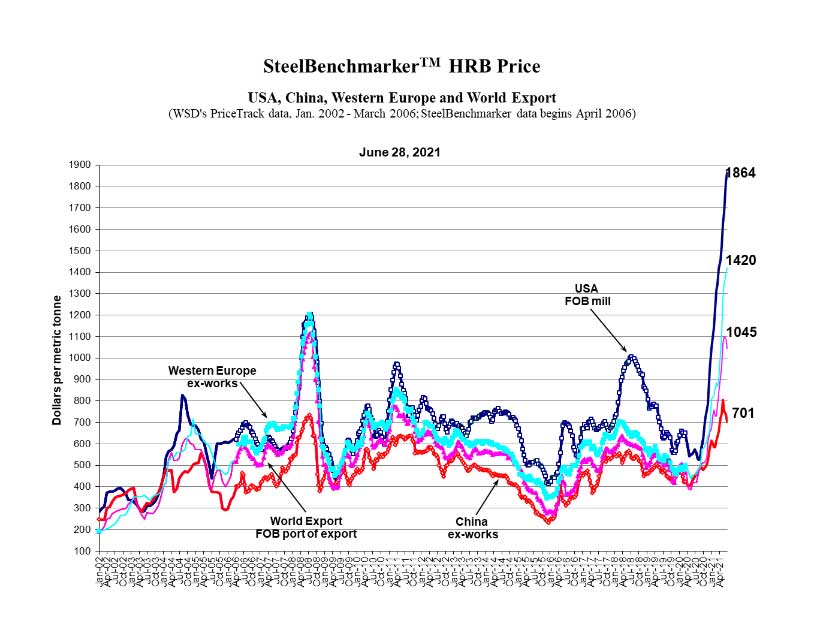

Steel, unlike copper, is actually in short supply. Steel is sold as it is made, and rarely is it ever stocked beyond commitment. Demand, and lead times on shipments, are pushing steel prices to new heights.

Hot Rolled Banded has never been more expensive, and has yet to wane. HRB is mostly construction metal, rebar, beams etc. And for us, it is the base for Galvanized pipe. As 2020 grew longer, and the more things opened up, GRC has steadily increased from its previous low of $520 per Metric Ton (MT) to end last summer. It is now trading above $1850. It has more than tripled in price.

I am pointing that out, since the cost of finished goods has NOT tripled in price, to match raw. Even with the cost of production and transportation being more expensive now. In fact, it has yet to double. Looking at our cost for GRC pipe, last September, it is only up about 75% right now. While still a lot, the factories still have room to grow, should they want to press that higher.

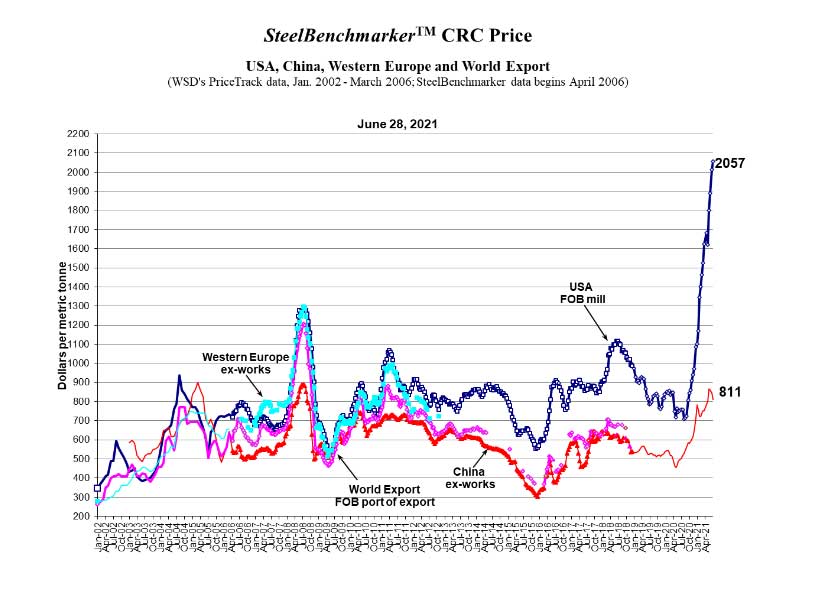

Cold Rolled Coiled is the most commonly used version of steel in the US. Cars, appliances, containers etc. And for us, EMT pipe, electrical boxes, steel fittings, metal light fixtures ETC. Movement within CRC most directly effects the cost of goods we sell.

Same as with HRB above, CRC recently bottomed out at the same time. It could have been had for $700 per MT less than a year ago. And despite one short blip earlier in the year, it too has risen to heights we have never seen before. It has nearly tripled in cost over the past 9 months. For finished tube, we are now paying 85% more today, than we did last September. And just like HRB, the factories that process still have room to raise costs for finished goods.